Why Acting Fast on Your Insurance Claim Roof Repair Matters

An insurance claim roof repair is a critical process for Pasadena homeowners who’ve experienced storm damage. Navigating it correctly can mean the difference between full coverage and thousands of dollars out of pocket. With the average roof replacement costing between $8,500 and $10,000, the financial stakes are high. Fortunately, your homeowner’s insurance is designed for these events, and getting help from a trusted Pasadena roofing contractor is the key to getting the coverage you deserve.

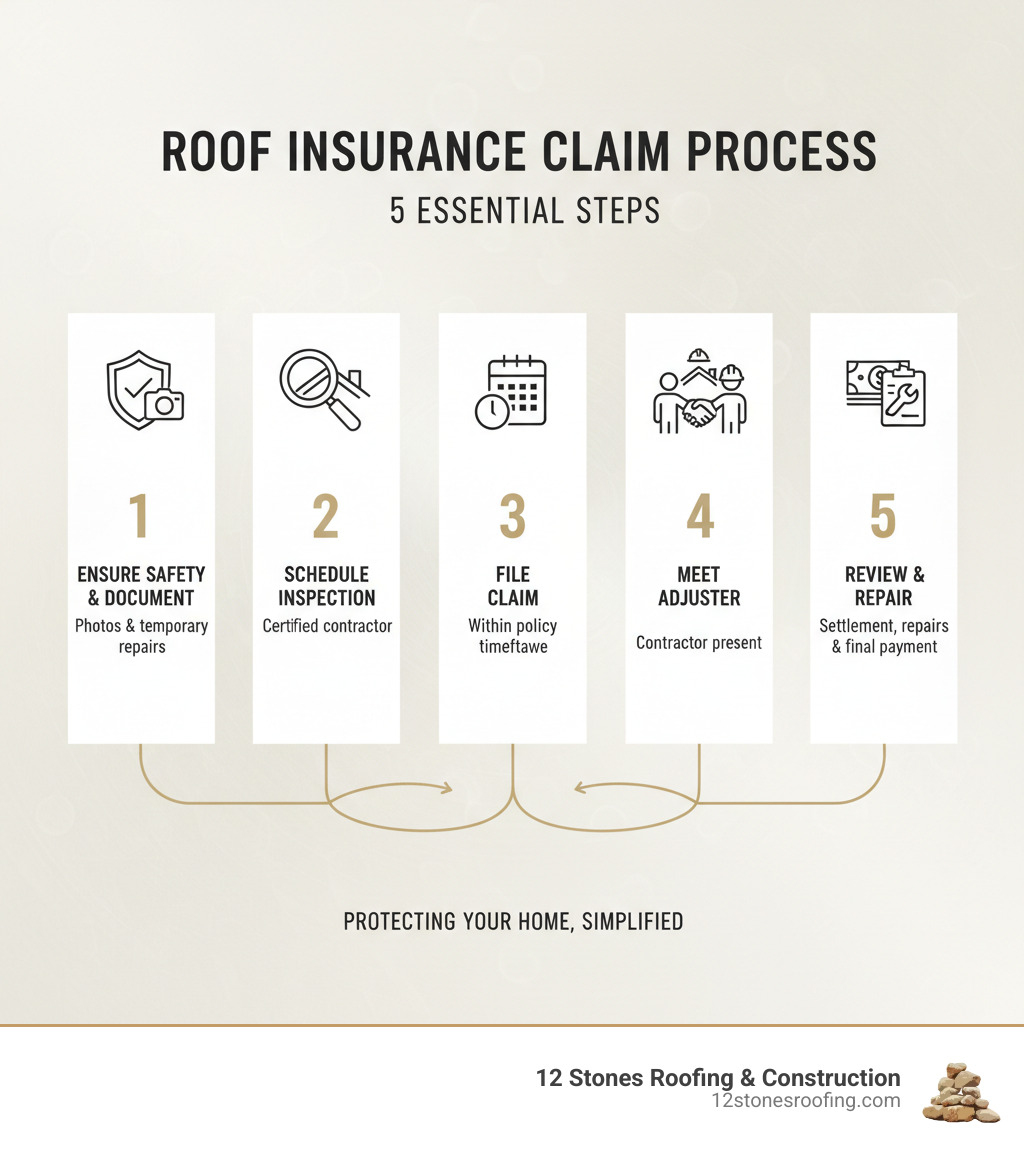

Quick Answer: Steps to File a Roof Insurance Claim

- Ensure Safety First: Stay off a damaged roof. Make temporary repairs like tarping only if it’s safe to do so.

- Document Everything: Immediately take clear photos and videos of all damage.

- Review Your Policy: Understand if you have an Actual Cash Value (ACV) or Replacement Cost Value (RCV) policy.

- Contact Your Insurer Promptly: Most policies require filing a claim within one year of the damage.

- Get a Professional Inspection: Hire a trusted contractor to assess the damage before the adjuster’s visit.

- Meet with the Adjuster: Have your contractor present during the insurance adjuster’s inspection.

- Review the Settlement: Compare the insurer’s offer with your contractor’s detailed estimate.

- Complete Repairs and Finalize: Submit the final invoice to your insurer to receive the remaining payment.

Time is critical. Most insurance policies require you to file claims within a specific timeframe, often one year. Waiting can result in automatic denial. Furthermore, unaddressed damage can spread, leading to interior water damage, mold, and rot that may not be covered. The difference between an Actual Cash Value (ACV) policy—which pays only the depreciated value of your roof—and a Replacement Cost Value (RCV) policy—which covers the full replacement cost—can leave you responsible for thousands in unexpected expenses.

I’m Jason Roberts, owner of 12 Stones Roofing & Construction. For over a decade, I’ve guided hundreds of Pasadena homeowners through the insurance claim roof repair process. My team works directly with insurance adjusters to document damage accurately, negotiate fair payouts, and complete quality repairs that protect your home for years to come.

After a storm, your first priority is safety. If you suspect structural damage, evacuate and call for help. Once safe, focus on documenting the damage with clear photos and videos from multiple angles. Note the date of the storm and when you found the damage. This evidence is invaluable. We recommend making temporary fixes like tarping to prevent water intrusion, as many policies require you to mitigate further damage. Our Emergency Roofing Services and roof tarping solutions provide quick protection in these situations.

Understanding Your Coverage: What Homeowner’s Insurance Actually Pays For

Not all homeowner’s insurance policies are created equal, and understanding your coverage is the foundation of a successful insurance claim roof repair. Policies are designed to cover damage that is sudden and accidental, not gradual deterioration.

What types of roof damage are typically covered by homeowner’s insurance?

Most standard policies cover damage from specific events, often called “perils.” Here’s what insurers typically pay for:

- Hail Damage: A common claim in Texas. Hail can strip protective granules from shingles and cause cracks, shortening a roof’s lifespan. The average wind and hail claim payout is around $13,000, highlighting the severity of this damage. Our Hail Damage Roof Repair guide offers more detail.

- Wind Damage: High winds can lift, crease, or tear off shingles, leaving your roof vulnerable.

- Fallen Objects: Damage from trees, branches, or other debris that falls during a storm is usually covered.

- Fire and Lightning: Damage from fire, smoke, or lightning strikes is almost universally covered.

- Sudden Accidental Leaks: If a storm punctures your roof and water gets in, it’s covered. However, leaks from old, worn-out roofing are not. The key distinction is whether the cause was “sudden.”

What are common reasons for roof insurance claims to be denied?

Understanding why claims are denied helps you avoid common pitfalls:

- Wear, Tear, and Age: Policies do not cover roofs that fail simply because they are old (typically over 20 years).

- Neglect or Lack of Maintenance: Insurers can deny claims if damage results from ignored issues like clogged gutters or unrepaired shingles.

- Pre-existing Damage: Damage that existed before the storm you are claiming is not covered.

- Improper Installation: If your roof fails due to poor workmanship, the claim should be against the contractor’s warranty, not your homeowner’s policy.

- Filing Too Late: Most policies have a strict filing deadline, often one year from the date of loss.

- Insufficient Documentation: Without clear photos, videos, and a professional inspection report, it’s difficult to prove your case.

Regular maintenance directly impacts your ability to file a successful claim. It keeps manufacturer warranties valid and prevents denials based on “neglect.” Documented inspections show you’ve acted as a responsible homeowner, strengthening your position during an insurance claim roof repair.

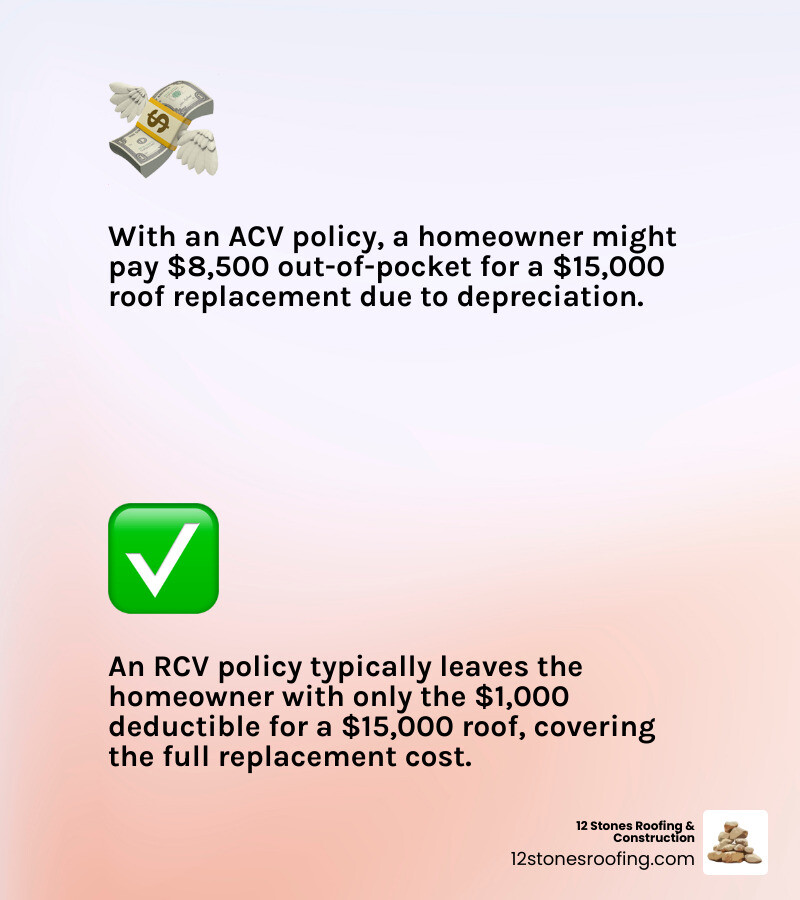

Navigating an Insurance Claim Roof Repair with ACV vs. RCV

The difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) policies is the most important factor determining your payout. This distinction can mean the difference between paying a small deductible and being responsible for thousands of dollars.

What is the difference between ACV and RCV policies?

An Actual Cash Value (ACV) policy pays for the depreciated value of your roof. The insurer calculates the replacement cost and then subtracts value for age and wear. If your 10-year-old roof has lost 50% of its value, an ACV policy will only pay for half the cost of a new one, minus your deductible. This often leaves homeowners paying thousands out of pocket.

A Replacement Cost Value (RCV) policy covers the full cost to replace your roof with new materials of similar quality, without a deduction for depreciation. This is the superior coverage. With an RCV policy, you first receive an ACV payment. After you complete the repairs and submit the final invoice from a contractor like 12 Stones Roofing & Construction, the insurer releases the remaining funds (the “recoverable depreciation”).

This table illustrates the financial difference:

| Policy Type | Initial Roof Cost | Age at Damage | Depreciation (e.g., 5% per year) | Depreciated Value (ACV) | Replacement Cost | Deductible (e.g., $1,000) | Initial Payout (ACV) | Final Payout (RCV) | Homeowner Out-of-Pocket |

|---|---|---|---|---|---|---|---|---|---|

| ACV | $15,000 | 10 years | $7,500 (50%) | $7,500 | $15,000 | $1,000 | $6,500 | N/A | $8,500 |

| RCV | $15,000 | 10 years | $7,500 (50%) | $7,500 | $15,000 | $1,000 | $6,500 | $14,000 | $1,000 |

As the table shows, an RCV policy holder pays only their deductible, while the ACV policy holder is left with an $8,500 bill. If you’re unsure what policy you have, contact your agent immediately. For more information, the Understanding Your Insurance Policy video series from GAF is an excellent resource.

The Ultimate Guide to the Insurance Claim Roof Repair Process

Filing an insurance claim roof repair can feel complex, but a clear roadmap makes it manageable. The single most important best practice is to have your own trusted roofing contractor present when the insurance adjuster inspects your roof. This step alone dramatically improves claim outcomes by ensuring all damage is documented.

How does a professional roof inspection support an insurance claim?

A professional inspection from a team like 12 Stones Roofing & Construction is invaluable. Our experts identify subtle damage that adjusters might miss, such as hail bruises or wind-lifted shingles. We provide a detailed report with photos and a precise cost estimate, which serves as powerful evidence for your claim. Most importantly, we act as your advocate during the adjuster’s visit, pointing out all damage to ensure it’s included in the scope of work. This prevents underpayment and ensures the settlement covers a quality repair.

What is the role of an insurance adjuster?

The insurance adjuster is the insurance company’s representative. Their job is to:

- Assess the damage to determine its cause and extent.

- Determine coverage by comparing the damage against your policy’s terms.

- Estimate repair costs using standardized software like Xactimate.

- Recommend a settlement amount to the insurer.

While most adjusters are professional, their goal is to find an economical solution for the insurer. Having your contractor present ensures a balanced and complete assessment.

Best Practices for a Smooth Claim Process

- Be Prompt: File your claim as soon as you find damage to meet policy deadlines (often one year).

- Document Everything: Keep a detailed file with photos, videos, receipts for temporary repairs, and a log of all communications with your insurer.

- Understand Your Policy: Know your coverage type (ACV vs. RCV), deductible, and exclusions before you file.

- Get a Professional Inspection: A contractor’s report provides the unbiased, expert documentation needed to support your claim.

- Have Your Contractor Meet the Adjuster: This is the most critical step to ensure all damage is identified and included in the report.

- Review the Settlement Offer Carefully: Compare the insurer’s estimate with your contractor’s. Question any discrepancies or missing items.

- Choose a Reputable Contractor: Work with a licensed, insured company experienced in handling Roofing Insurance Claims.

Essential Documentation for Your Insurance Claim Roof Repair

Solid documentation is the foundation of a successful claim. Without it, your claim is significantly weakened. Here is what you need:

- Date of Loss: The exact date the damage occurred.

- Photos and Videos: Clear images of all damage, including close-ups and wider shots. Photos of your roof before the storm are especially valuable. Also, photograph collateral damage to gutters, siding, or AC units to corroborate the storm’s severity.

- Professional Inspection Report: A detailed report from a licensed roofer outlining all damage and necessary repairs. Our Roof Inspection for Insurance service is designed for this purpose.

- Itemized Contractor Estimate: A detailed estimate for the cost of repairs that aligns with the scope of work.

- Receipts for Temporary Repairs: Proof that you took steps to mitigate further damage.

- Communication Log: A record of every conversation with your insurance company, including dates, names, and discussion summaries.

Navigating Challenges: What to Do If Your Claim is Denied or Underpaid

Receiving a denial for your insurance claim roof repair is not the final word. Many claims are initially denied or underpaid for reasons that can be successfully challenged. If you receive a low settlement offer or a denial, you have the right to appeal.

Understanding and Appealing a Denial

First, request a detailed written explanation for the denial. The letter should cite specific policy language. Common denial reasons include:

- Lack of maintenance or pre-existing damage.

- Filing too late (past the policy’s deadline).

- The adjuster concluding there is insufficient damage.

Once you understand the reason, review your policy and gather more evidence. A professional inspection from 12 Stones Roofing & Construction can provide a detailed report that contradicts the adjuster’s findings. Our reports have helped overturn countless denials by documenting damage the adjuster missed.

To build your appeal:

- Write a formal appeal letter referencing your policy and explaining why the denial is incorrect.

- Include all new evidence, such as your contractor’s report, additional photos, and weather data confirming the storm.

- Request a re-inspection with a different adjuster and insist that your roofing contractor is present.

Handling Underpaid Claims with Supplements

It’s common for initial settlement offers to be too low. They may use outdated pricing or miss necessary work. In this case, your contractor can file a supplemental claim. A supplement is a request for additional funds to cover costs not included in the original estimate, such as:

- Hidden damage found after work begins (e.g., rotted decking).

- Code-required upgrades.

- Line items the adjuster missed.

At 12 Stones Roofing & Construction, we handle supplemental claims regularly. We document the additional necessary work and submit it to the insurer to ensure your final payout covers the full cost of a proper repair.

When to Seek Additional Help

If your appeal is unsuccessful, you have other options:

- Hire a Public Adjuster: A public adjuster works for you, not the insurance company. They manage your claim and negotiate on your behalf for a percentage of the settlement. Their expertise can be invaluable for complex claims.

- File a Complaint: The Texas Department of Insurance can mediate disputes and investigate if your insurer acted in bad faith. This is a free service that can pressure insurers to reconsider unfair denials.

Persistence is key. Unrepaired roof damage will only worsen, leading to more extensive issues like leaks, mold, and structural problems that may not be covered later. Don’t give up on getting the fair settlement you deserve.

Frequently Asked Questions about Insurance Claim Roof Repair

Will filing a claim for storm damage raise my insurance premium?

In most cases, no. Insurance rates are typically affected by claims related to negligence, not by claims for damage from natural causes or “Acts of God” like a hailstorm or windstorm. Your rates are more likely to rise due to widespread storm activity in your entire region, not because of your individual, weather-related claim. Insurance companies generally view widespread weather-related claims as a cost of doing business in a particular area, and they spread those costs across all policyholders in that region. However, if you have a frequent history of filing claims, regardless of the cause, your individual premium could be affected, or your policy could even be canceled, though regulations require them to send notice.

How long do I have to file a roof damage claim?

Most insurance policies have a statute of limitations for filing a claim, which is often one year from the date the damage occurred. However, this can vary by policy and state. For instance, some states may allow up to several years. It is always best to act immediately after a storm to inspect for damage and file your claim as soon as possible to avoid any timeline-related issues. Waiting too long can not only lead to denial but also allow the damage to worsen, potentially leading to further, uncovered issues like mold or structural rot.

Can I keep the insurance money and not do the repairs?

No, this is considered insurance fraud. For a Replacement Cost Value (RCV) policy, the insurance company typically pays in two installments. The second payment (the recoverable depreciation) is only released after you provide an invoice from your contractor proving the work has been completed. The insurance payout for roof replacement is intended to be used for the repairs. Pocketing the money without performing the repairs can lead to severe legal and financial consequences, including having your policy canceled, being sued by your insurer, or even facing criminal charges. Furthermore, an unrepaired roof leaves your home vulnerable to future damage, which will likely not be covered by insurance.

Conclusion: Protecting Your Investment with a Successful Claim

Successfully navigating an insurance claim roof repair is essential to protecting your home’s value and safety. The process is manageable when you are proactive, document everything, understand your policy, and partner with a trusted professional.

A reliable local contractor is your most valuable ally. They don’t just fix your roof—they ensure damage is assessed correctly, advocate for you with the insurer, and complete repairs to the highest standard. This partnership ensures your home is protected for years to come.

For homeowners in the Pasadena area, the team at 12 Stones Roofing & Construction has the expertise to guide you through every step. We have spent over a decade helping local families steer complex insurance claims and restore their homes.

If you suspect your roof has storm damage, don’t wait. Time is critical for filing your claim and preventing minor issues from becoming major disasters. Reach out to us for a professional inspection and expert guidance. We’ll provide a comprehensive assessment and be by your side to ensure your claim is handled correctly from start to finish.

Your home is your biggest investment. Let’s protect it together.