Understanding the “Why”: The Role of Roof Inspections in Homeowners Insurance

A roof inspection for insurance is a professional evaluation that determines if your roof meets your insurer’s standards for coverage. Insurance companies use these assessments to manage financial risk, avoiding claims for pre-existing damage or failing roofs. For homeowners in Pasadena, TX, understanding this process is vital for protecting your property and wallet. As a leading Pasadena roofing contractor, we’ve seen how a proper inspection can prevent higher premiums, policy exclusions, or even denial of coverage.

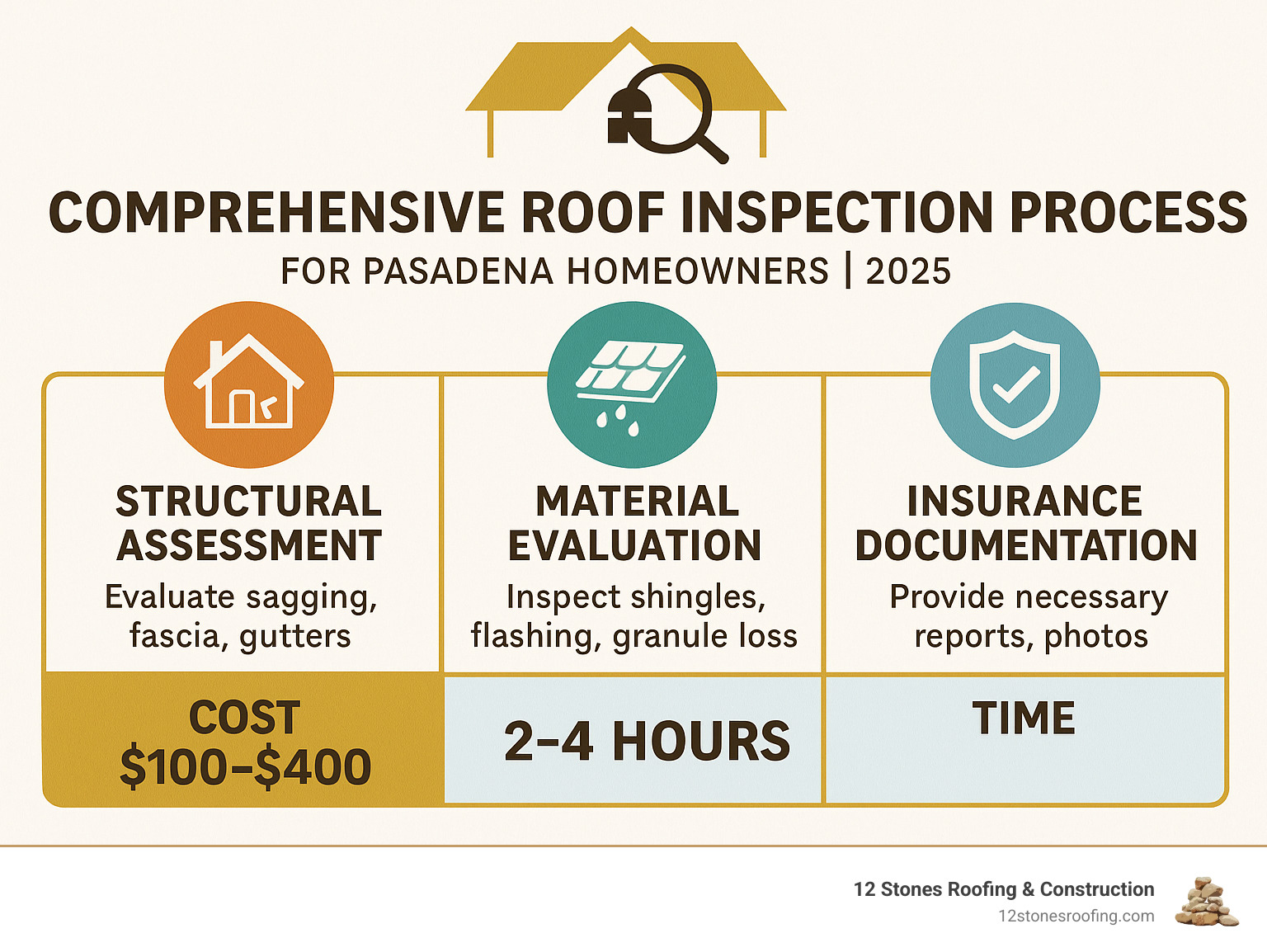

Key Facts:

- Purpose: Assess roof condition to determine insurance risk.

- Cost: $100-$400 (often paid by the insurer if they order it).

- Duration: 2-4 hours for most homes.

- Frequency: Annually recommended, or after major storms.

- Common Triggers: Roofs over 20 years old, new policies, storm damage claims.

What’s the Difference Between a Roof Inspection and a Roof Certification?

While both involve a professional examining your roof, they serve distinct purposes. A roof inspection is a general assessment of the roof’s current condition, identifying existing problems and wear. The outcome is a report detailing findings and recommending repairs.

A roof certification is a more formal document that provides an official statement on the roof’s expected remaining lifespan. It often includes a guarantee from the roofer that the roof will remain leak-free for a specific period (typically 1-5 years). Insurance companies often request a certification for older homes to assess their liability more precisely.

Here’s a quick comparison:

| Feature | Roof Inspection | Roof Certification |

|---|---|---|

| Purpose | Identify current problems & general condition | Guarantee expected lifespan & leak-free period |

| Scope | Visual and physical assessment of all components | Detailed assessment for lifespan, often with a guarantee |

| Outcome | Report of findings & recommendations | Formal document stating lifespan & leak warranty |

| When Required | General maintenance, buying/selling a home | Older homes (20+ years), specific insurance requirements |

A basic inspection might cost $100-$400, while a certification can add $75-$200 to the fee due to the added liability.

Common Triggers for an Insurance-Mandated Inspection

Insurers are masters of risk assessment, and certain circumstances will almost always trigger a mandatory roof inspection for insurance.

- Roof Age Over 20 Years: As roofs age, the risk of failure increases. Insurers will require an inspection or certification to ensure an older roof is still structurally sound.

- New Home Purchase: When you buy a home, your new insurer will want to know the condition of the roof they are about to cover. This is separate from a general home inspection.

- Switching Insurance Providers: A new provider will conduct its own risk assessment, which usually includes a roof inspection, to avoid inheriting problems.

- Policy Renewal: Insurers may request an inspection at renewal time, especially for aging roofs or after significant weather events in your area, to re-evaluate risk and adjust premiums.

- Filing a Claim After a Storm: If you file a claim for storm damage, your insurer will send an adjuster to inspect the roof, assess the damage, and determine if it’s covered under your policy.

The Inspector’s Checklist: What’s Examined During a Roof Inspection for Insurance

When a certified inspector arrives for a roof inspection for insurance, they conduct a comprehensive evaluation, not just a quick glance. This methodical assessment, which takes 2-4 hours, is broken down into three critical areas to create a complete picture of your roof’s health. The findings determine whether your roof passes or fails the insurer’s risk assessment.

Structural and Exterior Assessment

The inspection begins with the roof’s overall structural integrity. The inspector looks for problems that could lead to catastrophic failure.

- Roof planes: Are they straight, or are there signs of sagging or dipping that could indicate underlying structural issues?

- Fascia and soffits: The inspector checks for rot, water damage, or poor installation that could allow moisture to penetrate the roof system.

- Gutter system: Gutters are evaluated for proper attachment, slope, and blockages that could cause water to back up onto the roof or damage the foundation.

- Chimney condition: The flashing, masonry, and mortar are examined for cracks or crumbling that could create leak points.

- Flashing: All flashing around vents, skylights, and other penetrations is scrutinized for corrosion, cracks, or improper installation.

For comprehensive details on what a professional assessment includes, learn more about our Roof Inspection services.

Material Condition Check

Next, the focus shifts to the roofing materials, where Texas weather often leaves its mark.

- Shingle damage: Inspectors look for curling, cracking, granule loss, and missing shingles that compromise the roof’s protective layer.

- Moss or algae growth: This organic growth traps moisture and can accelerate shingle deterioration, especially in humid climates like Pasadena’s.

- Metal roofs: Rust spots are a red flag for corrosion that can weaken the metal and create leaks.

- Tile roofs: Cracked or broken tiles are identified, as they can allow significant water penetration.

- Pipe boots and seals: These rubber or metal components around vents are checked for cracks and shrinkage caused by heat, which can create gaps for water entry.

What Your Final Report Should Include for the Insurer

The final report is a formal document that underwriters use to assess financial risk. It must be thorough and professional.

- Detailed findings with photographic evidence: Every issue is documented with clear, dated photos to provide undeniable proof of the roof’s condition.

- Estimated roof age and material type: This data directly impacts the insurer’s risk calculations and premium pricing.

- Professional opinion on remaining lifespan: This assessment helps the insurer determine if you are a good risk or if repairs are needed.

- Mandatory or recommended repairs: The report must clearly outline the steps needed to mitigate risk, giving you a clear action plan.

- Adherence to industry best practices: A quality report will reference standards from organizations like the National Roofing Contractors Association, adding credibility to the findings.

Pass or Fail: The Outcomes of Your Insurance Roof Inspection

Once the roof inspection for insurance is complete, the results will directly shape your homeowners policy. A passing grade is a clean bill of health; your insurer sees your roof as a manageable risk, your policy is approved, and you may even qualify for premium discounts. But what happens if the news isn’t good?

What Happens if Your Roof Fails?

A failed inspection means your roof poses too high a risk for the insurer in its current condition. This isn’t the end of the world, but it requires action. Common outcomes include:

- Policy Cancellation or Non-Renewal: The insurer may decide to drop your coverage altogether.

- Increased Premiums: The insurer might keep you as a client but charge significantly more to offset the risk.

- Coverage Exclusions: Your policy might be amended to exclude the roof, meaning any future roof damage won’t be covered.

- Required Repairs: The most common outcome is a formal requirement to complete specific repairs by a deadline to maintain coverage.

From Failure to Favorable: Turning a Bad Report Around

A failed inspection report is a to-do list for getting your insurance back on track. The insurer will specify the issues that need addressing, giving you a clear roadmap.

- Get Quotes from Qualified Roofers: Contact reputable roofing contractors who understand insurance requirements. They can provide accurate quotes to address the specific concerns from the inspection report.

- Complete All Necessary Repairs: Once you select a contractor, prioritize completing the required work. Ensure they document the process with before-and-after photos and detailed invoices, as this will be crucial for the next step.

- Schedule a Re-Inspection: After repairs are finished, contact your insurance company to schedule a re-inspection. Providing all documentation of the completed work will demonstrate compliance and help expedite the approval process.

Addressing a failed inspection is an investment in your home’s long-term protection. A roof that passes an insurer’s inspection is one you can trust to protect your family.

Proactive Protection: Preparing for Your Inspection and Regular Maintenance

A roof inspection for insurance doesn’t have to be a stressful surprise. By taking a proactive approach with regular maintenance and preparation, you can take control of the situation. A little effort ensures you’re ready to pass any inspection with flying colors, fixing small problems before they become expensive headaches.

How to Prepare for a Smooth Inspection

Preparing your roof for an inspection shows you’re a responsible homeowner and helps the process go smoothly.

- Clear Debris: Remove leaves, twigs, and other debris from the roof surface and gutters. A clean roof allows the inspector to see everything clearly.

- Trim Tree Branches: Cut back any branches touching or hanging too close to the roof. This prevents scraping that wears down shingles and reduces the risk of storm damage.

- Ensure Attic Access: The inspector will likely need to check the underside of your roof deck for leaks or structural issues. Make sure the path to your attic is clear and safe.

- Gather Documents: Collect any warranties, receipts from past repairs, or maintenance records. This paperwork provides valuable context about your roof’s age and history.

The Long-Term Benefits of Proactive Roof Inspections

Scheduling your own inspections, even when not required by your insurer, is a smart investment.

- Catch Minor Issues Early: A small crack or loose flashing can be fixed cheaply before it leads to major water damage or structural problems.

- Extend Your Roof’s Lifespan: Just like maintaining a car, regular roof care can add years to its life, delaying a costly replacement.

- Prevent Unexpected Leaks: Proactive inspections identify vulnerabilities before they turn into a ceiling leak during the next big storm.

- Maintain Your Warranty: Many roofing warranties require proof of regular maintenance to remain valid.

How often should you schedule a roof inspection?

According to the International Association of Certified Home Inspectors, homeowners should have their roof inspected twice a year, ideally in the spring and fall. A spring inspection assesses winter damage, while a fall inspection prepares your roof for the coming cold.

Crucially, you should always schedule an inspection after a major weather event, like a hurricane or hailstorm. Hidden damage may not be visible from the ground. For insurance purposes, an annual professional inspection is a smart move, especially if your roof is over 20 years old.

The Financials: Cost, Payment, and Finding a Trusted Inspector in Pasadena

Understanding the financial side of a roof inspection for insurance helps you budget accordingly. Who pays often depends on who requests it. If your insurance company orders the inspection, they typically cover the cost. If you hire an inspector proactively or for a second opinion, the cost is yours—a worthwhile investment in your home’s protection.

What is the typical cost of a roof inspection?

A professional roof inspection generally costs between $100 and $400. The price varies based on:

- Size and Complexity: A large, multi-level roof with many peaks and valleys costs more to inspect than a simple ranch-style roof.

- Roofing Material: Inspecting a standard asphalt shingle roof is different from examining slate or tile, which requires specialized knowledge.

- Geographic Location: Costs can vary by region. In Texas, inspectors must be familiar with damage from heat, hail, and high winds.

- Specialized Technology: Inspections using drones or infrared scanning can cost between $200 and $600 but can spot hidden issues.

Considering an inspection can prevent thousands of dollars in future repairs, the fee is a small price for peace of mind.

Finding a Qualified Inspector in Pasadena, TX

When your insurance coverage is on the line, you need a qualified inspector. In Pasadena, this means finding a local, licensed, and insured professional who understands the challenges of Texas weather. They should have proven experience identifying damage from scorching heat, hail, and high winds, and know what local insurance providers require in a report.

At 12 Stones Roofing & Construction, our team has served the Pasadena community for years. We combine technical expertise with a deep understanding of local weather patterns and insurance standards to provide assessments you can trust.

12 Stones Roofing & Construction

Address: 6933 Olson Ln, Pasadena, TX 77505

Phone: (832) 815-9463

Conclusion

A roof inspection for insurance is more than a requirement; it’s a vital tool for managing your homeowners policy and protecting your investment. By understanding why insurers request inspections, what inspectors look for, and how to prepare, you can steer the process with confidence. A failed inspection isn’t a final verdict but a clear roadmap for necessary repairs.

The key takeaway is that being proactive is always better than being reactive. When you prepare your property and partner with a trusted local professional, you turn a requirement into an opportunity to secure your home’s long-term safety.

For homeowners in the Pasadena area, 12 Stones Roofing & Construction offers the local expertise needed to handle any inspection. We understand Texas weather and know what insurance adjusters require. Your roof works hard to protect your family; let us help you ensure it’s in peak condition and meets all insurance standards.

Ready to take the next step? Contact our team of expert roofers in Pasadena today for a comprehensive assessment that provides peace of mind and keeps your coverage secure.